Republicans have been campaigning on the claim that Democrats are recklessly spending America into huge amounts of debt. The Republican solution is, of course, to cut the budget down to erase the deficit.

Here’s the problem with what Republicans are saying: Republicans add more to the debt than Democrats do, and America truly cannot cut its way to a surplus.

Let’s take a look.

We will start with the fact that it isn’t possible to cut the federal budget enough to eliminate the deficit.

In 2023, the federal government brought in $4.44 trillion in revenue, which, for the US, is largely taxes. Individual taxpayers make up the largest portion of revenue, followed by payroll and corporate taxes—the $4.44 trillion amounts to 16.5% of the US GDP.

The federal government spent $6.14 trillion, giving America a deficit of $1.7 trillion. Here are the largest expenditures for the federal government:

Social Security - $1.4 trillion - Social Security does not add to the debt because of how the system is set up.

Healthcare (Medicare, Medicaid, ACA, CHIP) - $1.5 trillion - both sides of the aisle agreed not to cut Medicare/Medicaid in past budget discussions.

Interest on Debt - $660 billion - no way around this expense. We have to pay our interest owed.

Defense Budget - $820 billion - despite the US defense expense being 4x that of the next highest spender and knowing that military contractors are price gouging the defense department, no one in Washington wants to cut the defense budget. In fact, the budget is almost $900 billion for 2024.

Those items already used up the entire 2023 federal revenue.

Then we have programs like:

Veterans/federal retirement programs - $475 billion - $95 billion is specifically for Veterans programs, which are underfunded, so no cuts should happen there. Retirement programs are guaranteed after many years of service. There could be changes to future retirement plans, but they are unlikely to have cuts on current retirees.

Economic Security Programs - $522 billion - includes the child tax credit, school lunch assistance, and SNAP. This is where Republicans have focused most of their attacks on cuts despite how little of a change those cuts would have on the deficit and the significant amount of hardship those cuts would create.

Education - $80 billion

Transportation - $41 billion

From there, it gets into smaller programs.

So, how are Republicans going to cut their way to a surplus? They won’t because they can’t. The last time the US had a surplus was when President Clinton was in office, which was a rare moment.

Let’s look at the other side of the equation: taxes.

Corporations and the wealthy have had constant tax reductions since the 50s and 60s. All of this means lower revenue for the federal government, which means more debt.

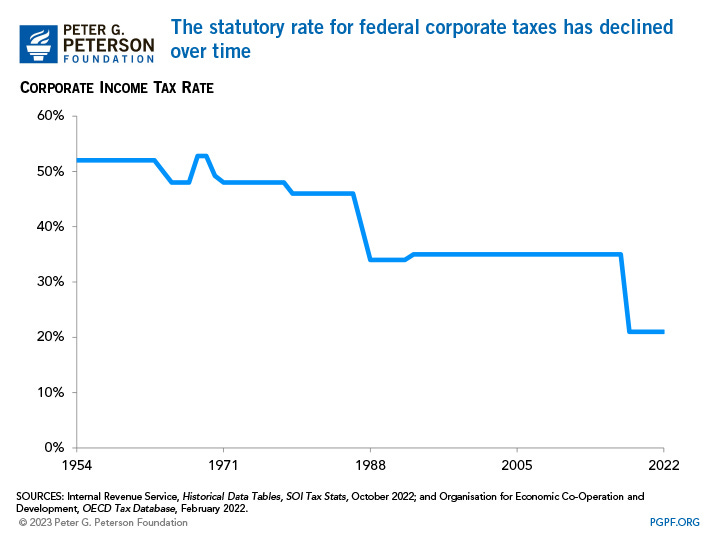

Here is the statutory corporate tax rate over time in the US. The last reduction was in 2017 as part of the Tax Cuts and Jobs Act:

The actual result is even worse than that graph suggests. That is because corporations have numerous loopholes to reduce their tax burden.

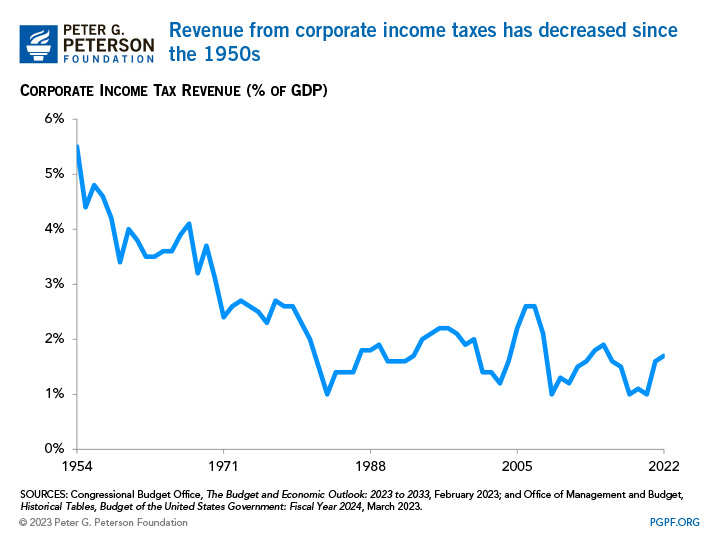

The average corporation tax rate was 16% in 2014 and down to 9% in 2018. Last year, Amazon paid a 6% tax rate, and Google paid a 9% tax rate. The wealthiest entities in the world are paying a tax rate lower than the lowest personal tax bracket.

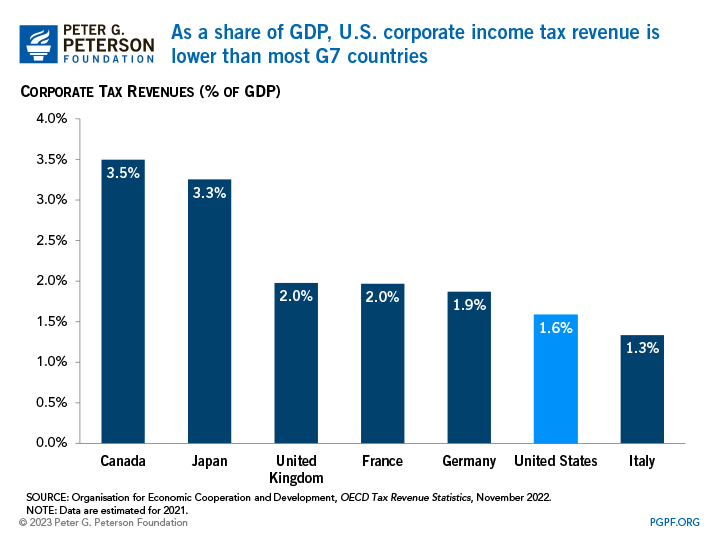

Those loopholes play a major role in America’s debt problems. Here is a look at actual tax revenue from corporations and how it compares to other G7 nations:

As part of President Biden's Inflation Reduction Act, corporations with over $1 billion in revenue will be forced to pay a minimum tax of 15%. This will help stop companies like Amazon from avoiding billions in taxes.

Now taxes for the wealthy:

The top marginal tax rate went from 91% in the early 60s to 37% today. It also happens that the minimum wage buying power peaked in 1968, and the middle class was at its strongest point in the late 60s/early 70s. It is not a coincidence that as corporate and wealthy tax rates were reduced significantly, wealth inequality exploded, and the middle class has been largely erased.

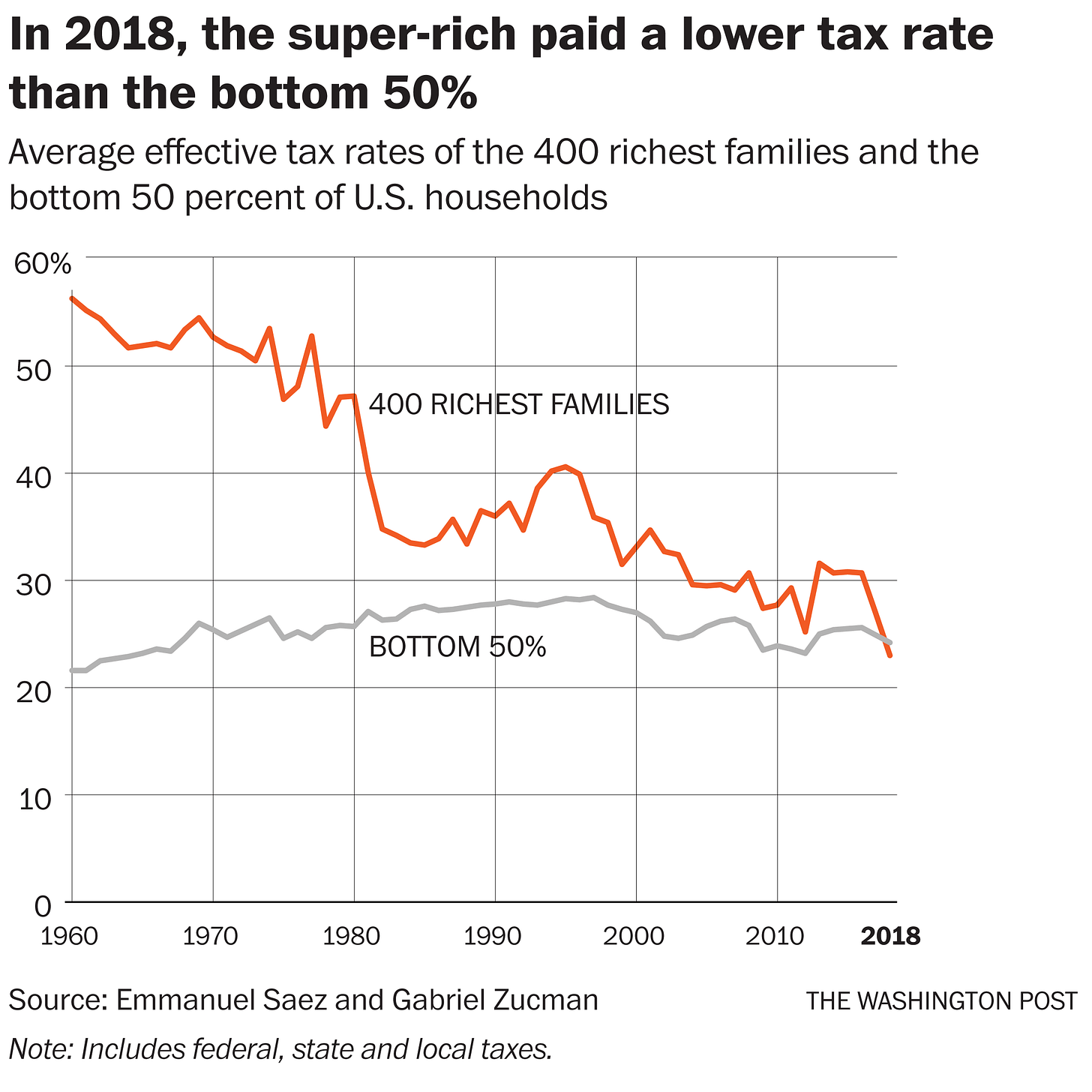

If that isn’t depressing enough, here is a chart of the effective wealthy tax rate over time:

Yes, the richest Americans pay a lower effective tax rate than the bottom half of Americans. And yet the Republican debt discussion is to cut programs that help the poorest Americans survive, including providing food for needy children, all while pushing for more tax cuts for the wealthy.

The simple fact is that making corporations and the wealthy pay a more appropriate effective tax rate would allow us to eliminate our deficit.

Now, let’s discuss the debt itself.

If you were to only listen to Republican politicians, you would think that America’s debt is about to cause our nation to implode, causing chaos and suffering. That is an extreme exaggeration.

Republicans enjoy repeating the dollar amount of US debt, which is $34 trillion. However, the dollar amount doesn’t determine a nation’s debt; it is determined by the ratio of debt to GDP, which shows the ability of a country to pay down its debt.

The US had a GDP of over $27 trillion in 2023. If the US debt were just $1 trillion, no one would be talking about it despite how large of a number $1 trillion is. Luxembourg on the other hand has a GDP of $85 billion, if that nation somehow accrued $1 trillion in debt it would be a total catastrophe that would destroy the nation. That is why the total value isn’t what matters but the ratio to GDP.

Is the US debt a concern that we should be working to address? Yes.

Will our nation fall apart if our debt stays at this level for the next decade? No.

Trump increased the debt by 40% in just one term, and this isn’t only because of the pandemic. The Tax Cuts and Jobs Act mentioned earlier exploded the US debt, and even Trump’s administration was concerned about how fast the debt was rising before the pandemic hit.

The debt has increased significantly under Biden when looking at just the dollar amount, although not as much as under Trump.

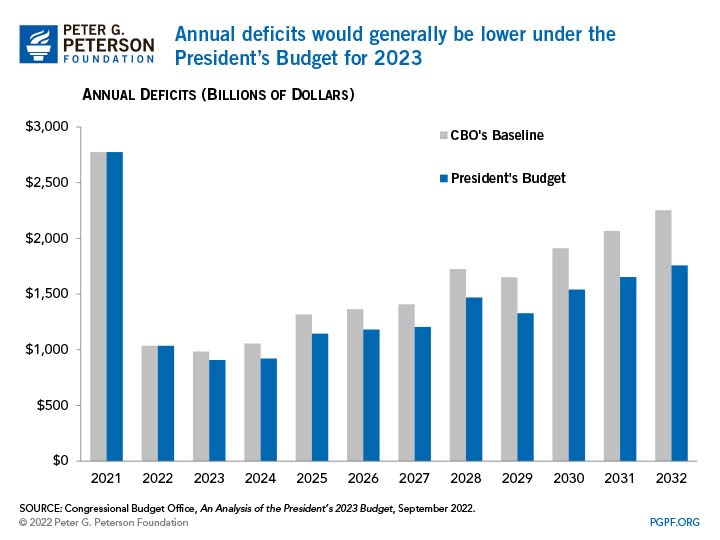

You might have heard Biden claim to have reduced the debt and been confused by that. Biden is referring to over the next 10 years. Biden’s budget proposals would slow the increase in debt, which is a step in the right direction. Here is an analysis of that change:

Beyond that, Biden has also experienced incredible GDP growth. That level of GDP growth can’t be maintained forever, but it has helped with debt when measuring it as a ratio of GDP.

We see that Biden has reduced spending every year in office and increased GDP growth, especially in 2023. That is why Biden can claim that he is reducing the debt.

To summarize:

Republican Presidents have added more debt on average than Democrat Presidents

Trump increased the debt by 40% in large part because of tax cuts

Biden has reduced spending and improved GDP growth to address debt

There is hardly any spending we can cut to even dent the deficit, let alone erase it

The only way to significantly tackle the deficit and debt is with taxes, and that can be solved with taxes on corporations and the wealthy

Keep all of this in mind as Republicans spend the next couple of weeks complaining about Democrat spending while refusing to adjust taxes. And be upset by this if Republicans shut down the government. Historically, shutdowns have only increased the debt, not reduced it.

Costly Government Shutdown

In just 7 days the federal government could be shutdown due to a failure to pass a budget. While it is easy to blame both sides of the aisle and all of Congress, far right Republicans are not only holding out for extreme policy goals, they are actively pushing for a shutdown.

"Even a low 1% annual tax on wealth would be enough to fill the entire funding gaps of Social Security and Medicare in perpetuity, data from the Federal Reserve, the Congressional Budget Office and the two programs’ trustees show." beginning with "Curiously" -- about paragraph 25 :

https://www.marketwatch.com/story/what-house-speakermike-johnson-has-said-about-social-security-and-medicare-babdf384