American crop farmers are facing severe financial trouble from both sides of Trump’s trade wars. On the one side, potash, a key ingredient for fertilizing crops, and farm equipment have increased in cost due to the tariffs applied on imports. On the other side, China has reduced its purchases of US exports, such as soybeans, in retaliation for the tariffs.

The result is increasing farm bankruptcies and creating an uncertain future for those still operating.

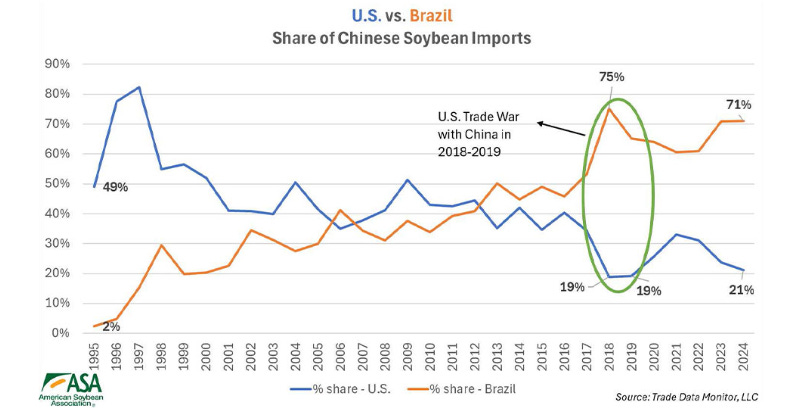

This isn’t a new situation for Trump, who had to bail out American farms with over $30 billion during his first term due to his trade war with China. That confrontation led to a permanent shift in China's agricultural purchases, with more coming from Brazil and less from the US. A situation that has escalated with the latest trade wars.

This causes ripple effects, as seen in the case of John Deere, which achieved record profits just two years ago but is now resorting to layoffs to cope with higher prices resulting from tariffs on raw materials like steel and aluminum. These tariffs will cost the company an expected $600 million this year alone.

Like farmers, John Deere is facing the fallout from tariffs on both ends, with a decrease in new equipment purchases as struggling farms focus on fixing the equipment they have or buying older, used equipment to get by. John Deere reported a third-quarter income that was 25% lower than the same time last year, a reduction of $500 million.

Trump shows no sign of backing off from his disastrous tariffs, even as the economy comes to a halt, inflation rises, unemployment rises, layoffs are plentiful, hiring is slow, and there are more unemployed people than there are job openings in the US. But, even if he ended his trade wars, a significant portion of agricultural exports will not return because other nations have made new trade agreements with our competitors to get what they need.

So what can be done? America can use this moment to change how we approach farming subsidies, crops, and our food supply.

Farming subsidies come in at over $30 billion annually, through programs to cover crop insurance, risk, price loss, and more. But in many ways, these subsidies are causing more harm than creating good.

60% of subsidies for crop insurance, risk coverage, and price loss go to the largest 10% of farms. Only 23% of farms with an annual revenue under $100,000 receive federal subsidies, but 69% of farms above that threshold do. One study found that dozens of individuals on the Forbes top 400 list were receiving subsidies—more handouts for the wealthiest Americans. Even that farm bailout money from Trump’s first-term trade war disproportionately went to the rich, with 66% of payments going to the top 10% of recipients.

These subsidies drive behavior more than protect family farmers. Corporate farms acquire land in areas not suited for crop cultivation, and subsidies enable them to collect money for lost crops when conditions become unfavorable. Subsidies also play a significant role in determining which crops are grown, with corn receiving over 30% of subsidies last year, and soybeans receiving another 18%.

Almost half of the subsidies went to just those two crops. And those crops aren’t being used for food. Only 1-2% of the corn that is grown in the US is eaten by consumers. The rest is turned into livestock feed, ethanol, corn syrup, and other products. The quality of meat in the US is lower when animals are primarily fed corn instead of grass. However, when corn is heavily subsidized, the cost of feed is low, prompting farmers to use it to reduce their expenses. Less than 2% of food subsidies go toward healthy food.

Once again, a system that was initially created to help hard-working Americans stay afloat during tough times has been twisted into a profit machine by corporations and special interests. It is time for a reset.

There should be no subsidies for large corporate farms. They can manage their own risk.

There should be no subsidies for products that make America less healthy or that worsen our environment.

There should be no subsidies for crops that are grown for exporting. Using American taxpayer money to allow businesses to get rich from overseas customers with no benefit to the broader American population is an abuse of government spending.

Subsidies should only be used to help small, independent farms sustainably provide food for the local community and help strengthen rural economies.

This means helping these small farms switch from producing highly processed corn or soybeans to growing fruits, vegetables, and grains. It also means helping these small farms modernize to become more efficient and less reliant on human labor.

Agriculture in the US continues to face a worsening labor crisis. Younger Americans aren’t interested in farm work, leading to an aging domestic workforce. And increased immigration crackdowns have reduced the migrant labor force. However, these smaller farms lack the funds to modernize their operations and acquire new equipment—a situation exacerbated by tariffs.

Our tax dollars should be working to improve our nation, improve our food supply, increase access to healthy food, and reduce costs, not help corporations increase their wealth through actions that make life worse for the rest of us and our nation.

It is time for Republicans in Congress and the White House to do what they always claim to do and put America first.

https://www.cato.org/briefing-paper/cutting-federal-farm-subsidies#types-farm-subsidy

https://usafacts.org/articles/federal-farm-subsidies-what-data-says/

Produce Prescriptions are Practical Policies

When facing a monumental problem, you need to think outside the box for novel and creative solutions. America has a monumental health problem. 700,000 Americans died from heart disease, and 600,000 died from cancer in 2021.