Fixing Personal Income Taxes

US income tax law is longer than The Lord of the Rings and Twilight book series combined. Adding regulations increases the total page count by thousands. Then there is the compilation of income tax caselaw, required understanding for any competent tax lawyer, and the total rises to 70,000 pages. To say that income tax law is a cumbersome mess is an understatement.

This is because politicians use it as a way to create tax breaks through loopholes without reducing the rates to hide what they’re doing. It is also where incentives are placed because it is a lot easier to get something like a child tax credit through Congress than it is to approve sending parents a check.

This mindset fosters a system that creates unnecessary complexity, requiring most Americans to use tax preparation services that charge them hundreds of dollars to ensure proper payment to the government. It enables rampant corruption, necessitating a significantly larger IRS to handle complex tax evasion cases, or for the government to relinquish its efforts to collect unpaid taxes, thereby increasing the debt burden on the rest of us.

Instead of addressing these problems, Trump signed a bill into law giving more tax breaks to the wealthy and transferring wealth from the poorest Americans to the richest. It also adds trillions to the national debt.

What should have been done, and what needs to be done, is to start from scratch. A new income tax law that redefines tax brackets, increases working and middle-class prosperity, requires the government to handle annual income tax filing and reduces the deficit.

Here’s how that would work:

America would implement a new individual income tax law that simplifies the system by:

Eliminating all deductions.

Requiring everyone to file as a single payer

Treating capital gains as regular income

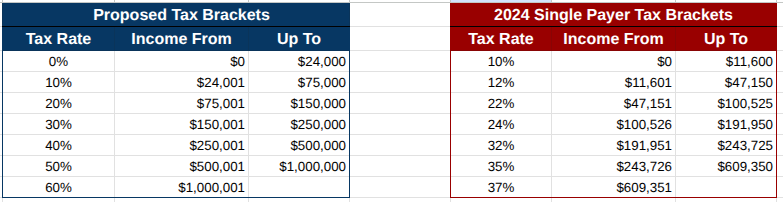

Establishing new tax brackets

Like the existing income tax system, this proposal uses a progressive income tax. No matter how much you make, even if you make over $1 million in a year, the first $24,000 isn’t taxed. The next $51,000 is taxed at 10%. The following $75,000 is taxes at 20% and so on.

This is intended to work alongside the guaranteed minimum income from the previous article (link at the end of this article). That proposal uses a negative income tax where anyone earning less than $24,000 is given a stipend from the government that caps out at $12,000 per year. That system replaces all of the food and housing federal aid programs.

It isn’t easy to see how this compares to the 2024 tax rates without some examples.

The median income in the US is $40,000.

Someone earning $40,000 in 2024 would have paid $2,816 in federal taxes, taking into account the standard deduction. Under the proposed system, with no deductions, the same person would pay $1,600.

The median household income is $78,000.

Since it is a household income, we will start by considering a couple married filing jointly. A typical income tax in 2024 would have been $5,392. Under this new proposal, if one half of the couple earned all of the income and the other earned $0, they would have a tax of $5,700, which sounds worse, until you factor in that the spouse who previously had no income now has a $12,000 stipend making the couple $11,692 wealthier than under the current tax system. Even a two-parent family with four kids that was claiming child tax credits would be better off in this scenario, where the child tax credit doesn’t exist.

If the $78,000 is a single filer in 2024, they would be paying $9,001 vs $5,700 under the proposed system.

Finally, we will look at a household or individual with an income of $175,000.

A two-parent household filing jointly would pay $21,398 in income tax in 2024. Under the proposed system, if one of the spouses was the sole earner and the other earned nothing, the tax would be $27,600, but again, the spouse who was earning no income now earns $12,000, reducing their tax burden to $15,600. If both spouses earned half the total, they would each have a federal income tax of $7,600 for a total of $15,200.

An individual filer would have paid $31,538 in 2024 vs $27,600 with the proposal.

Looking at 2022, the most recent year with complete tax data available from the IRS, the federal revenue from income tax was $2.6 trillion, and the overall deficit was $1.8 trillion. The proposed system would have brought in an estimated $3.4 trillion, reducing the deficit by $800 billion, almost cutting it in half. The methodology for this estimate is at the bottom of the page.

How is it possible to substantially reduce the deficit while keeping more money in the pockets of working and middle-class Americans? By ensuring that the wealthiest Americans pay an appropriate tax rate and aren’t given so many loopholes that they pay a lower effective rate than teachers and firemen.

By keeping taxes simple, not only is it much harder for cheats to get away with their crimes, but the IRS headcount can be reduced. The agency can also file taxes for the majority of Americans. The government doing your taxes isn’t a revolutionary thought. Denmark does it. Other countries have the responsibility on the employer, including the United Kingdom and Spain. You can, of course, challenge your tax return if you feel there is an error when you receive it; otherwise, it is a big hassle removed from your life.

We have a right to know where tax dollars are being spent. Our annual tax returns should have a breakdown showing what our money went to. And, the federal government should be required to maintain an up to date, modern website and app that makes it easy for a layperson to see and understand the entirety of the budget, not just down to department, but to specific projects along with high-level details of what those projects’ goals and responsibilities are.

Appropriately used, taxes give the public a better quality of life than would be possible if we spent that money individually. Our money is combined to cover large projects, national security, and services that benefit us all. We must demand proper tax rates that address our debt and needs efficiently and effectively, and a system that works better for the American people. If Congress doesn’t deliver, fire them in the next election and keep doing so with each new election until they remember who they work for.

https://taxfoundation.org/blog/how-many-words-are-tax-code/

Basic Income Is A Powerful Solution

We're born into a world where everything is owned, jobs don’t pay enough to cover the bills, and we’re told that guaranteeing a minimum standard of living is a handout. This is the design of the privileged to ensure they hold money and power while generational poverty abounds.

Methodology

The IRS releases income tax reports here: https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns

I used the 2022 report as the basis for how much money the proposed tax brackets would generate. The number of filers in a given tax bracket was multiplied by the maximum income for the previous bracket.

Example: A filer in the $30-50k bracket was multiplied by $24,000, the maximum for the 0% tax bracket.

That total was subtracted from the total gross revenue for that tax bracket since the previous bracket had already taxed it. The remaining amount was multiplied by the tax percentage for the filer’s top tax bracket. That total was added to the total of the number of filers multiplied by the maximum income tax paid by the previous bracket.

For tax data brackets whose average income fell on the maximum income for a proposed tax bracket, the filers were multiplied by the maximum tax paid by that tax bracket. The $100k-$200k average is $150k, which is the maximum of the 20% tax bracket. Therefore, all filers were multiplied by the income tax paid by someone making $150k.

The 2022 data had everyone with a gross income of $250k and above grouped into one bucket, which didn’t work well for estimating how much the new proposed income tax brackets would collect. The 2011 report had more groupings beyond $250k. I calculated the percentage of the total 2011 filers earning $250k and above for each bracket, and then repeated this process for the total gross income. Those percentages were applied to the 2022 $250k+ filers and gross income totals to break them into extra brackets to improve the estimates.